Figuring out your overhead rate is straightforward: add up your indirect operating costs for a set period, then divide that total by a key business metric like total sales or labor hours.

That simple calculation turns a long list of fixed and indirect expenses into one critical number. Your overhead rate shows the true cost of keeping your restaurant running, beyond food and labor.

Why Your Overhead Rate Is a Critical Profitability Metric

Restaurant margins are tight, and overhead costs are often the silent profit killers. While food and labor get most of the attention, expenses like rent, utilities, insurance, and administrative costs quietly stack up in the background.

Knowing your overhead rate helps you move from assumptions to informed decisions. It tells you whether your pricing actually covers your operating reality and whether new revenue opportunities are truly profitable once indirect costs are factored in.

From Guesswork to Strategy

Overhead includes any cost required to operate your restaurant that cannot be tied directly to a single menu item or service. Before you calculate your overhead rate, you need a clear and accurate view of these indirect expenses.

Common Restaurant Overhead Costs at a Glance

Below is a breakdown of the most common overhead costs restaurants should track. Getting this list right is the foundation of an accurate overhead rate calculation.

| Overhead Category | Examples for a Restaurant |

|---|---|

| Facility Costs | Rent or mortgage payments, property taxes, building insurance, and common area maintenance (CAM) fees. |

| Utilities | Electricity, natural gas, water, garbage collection, and internet/phone services. |

| Administrative | Salaries for managers and office staff, accounting/bookkeeping fees, and payroll service costs. |

| Marketing and Sales | Advertising, social media management, PR, menu printing, and website hosting. |

| Technology | Point-of-sale (POS) system subscriptions, reservation software fees, and security systems. |

| Repairs and Maintenance | Equipment repairs, pest control, hood cleaning, and general building upkeep. |

| Supplies | Office supplies, cleaning supplies, and disposables (that are not tied to a specific dish). |

| Licenses and Fees | Liquor license, health permits, business licenses, and bank fees. |

Once you have tallied these up, you can start putting them to work.

By calculating your overhead rate, you can assign a fair share of these indirect costs to every single thing you sell. This leads to much more accurate menu engineering, smarter budget forecasting, and strategic pricing that protects your bottom line.

In an industry where margins often hover around a slim 3% to 5%, getting this right is nonnegotiable. Knowing your overhead rate turns a pile of abstract bills into actionable data. It’s the difference between hoping you’re profitable and building a clear financial roadmap to ensure you are.

Ultimately, this calculation is the foundation for understanding your restaurant’s financial health. To see how overhead fits into the bigger picture, it’s worth comparing it against other key industry ratios for restaurants. This knowledge empowers you to build a more resilient and profitable business from the ground up.

Choosing the Right Formula to Calculate Overhead

Alright, you have wrestled all your indirect costs onto a spreadsheet. Now what? The next step is picking the right way to calculate your overhead rate, and not every formula works for every restaurant.

Your choice should feel right for your specific operation. Are you a labor-heavy fine dining spot where service is everything? Or are you a quick-service kitchen that leans hard on tech and throughput? The right formula will reflect how your business actually runs.

Once you have a clear list of your indirect costs, the next step is choosing the right way to calculate your overhead rate. Not every formula fits every restaurant, and the best option depends on how your operation actually functions day to day.

Your overhead formula should reflect reality. A labor-intensive fine dining restaurant will benefit from a different approach than a high-volume, tech-driven quick-service operation. The goal is to choose a method that mirrors where your costs truly live.

Before applying any formula, accuracy matters. Reliable overhead calculations depend on having complete, well-organized expense data. When costs are tracked inconsistently or incompletely, the resulting overhead rate becomes misleading and difficult to act on.

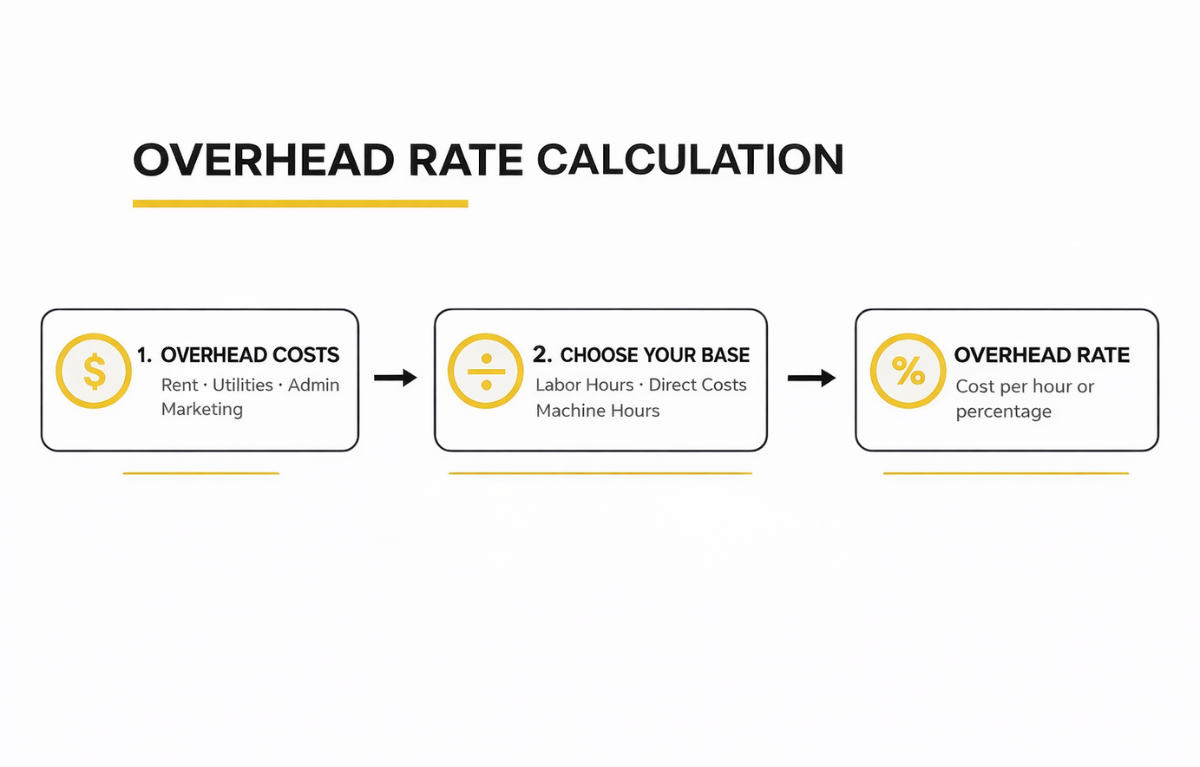

The good news is that the process itself is straightforward. Once your data is solid, calculating overhead comes down to three clear steps.

The whole process is simpler than it sounds. It really boils down to three core steps.

You gather your costs, divide them by a key business metric, and get your rate. Let’s break down the most common formulas that put this into practice.

The Direct Labor Hours Method

For a ton of restaurants, especially full-service concepts, labor is the single biggest engine driving the business. If that sounds like you, then using direct labor hours as your base for allocating overhead just makes sense. It’s intuitive and directly connects your back-office expenses to the hours your team is on the floor and in the kitchen, making it all happen.

We get into the nitty-gritty of labor costs in our guide on how to calculate labor cost percentage. It is worth a read.

The formula itself is clean and simple:

Overhead Rate = Total Overhead Costs / Total Direct Labor Hours

Let’s say your restaurant’s monthly overhead totals $20,000. During that month, your kitchen and front-of-house staff worked a combined 2,000 hours. Your overhead rate would be $10 per direct labor hour.

This number is huge. It means for every single hour a cook or a server is clocked in, you need to account for $10 in overhead just to break even on that hour.

The Percentage of Direct Costs Method

This method is a powerhouse for multi-unit restaurant groups or franchises where you’re trying to keep operations lean and consistent across the board. It calculates your overhead as a percentage of all your direct costs, which means labor and your cost of goods sold (COGS) are bundled together.

Here’s what the formula looks like:

Overhead Rate = (Total Overhead Costs / Total Direct Costs) x 100

This approach is incredibly useful in hospitality, an industry where direct costs can easily eat up a massive slice of your revenue.

The Machine Hour Rate Method

Okay, this one used to be less common for old-school restaurants, but it’s becoming more and more relevant. If you’re running a ghost kitchen with a ton of automation or a QSR with high-tech cooking equipment, this might just be the most accurate method for you.

Instead of people, it allocates overhead based on the hours your key machinery is running.

Overhead Rate = Total Overhead / Total Machine Hours

Picture a high-tech pizzeria where a massive, specialized conveyor oven is the heart of the entire operation. If the monthly overhead is $15,000 and that oven runs for 300 hours, the overhead rate is $50 per machine hour. This helps you get deadly accurate when costing out menu items based on the equipment they depend on.

Calculating Overhead Rate: A Real-World Restaurant Example

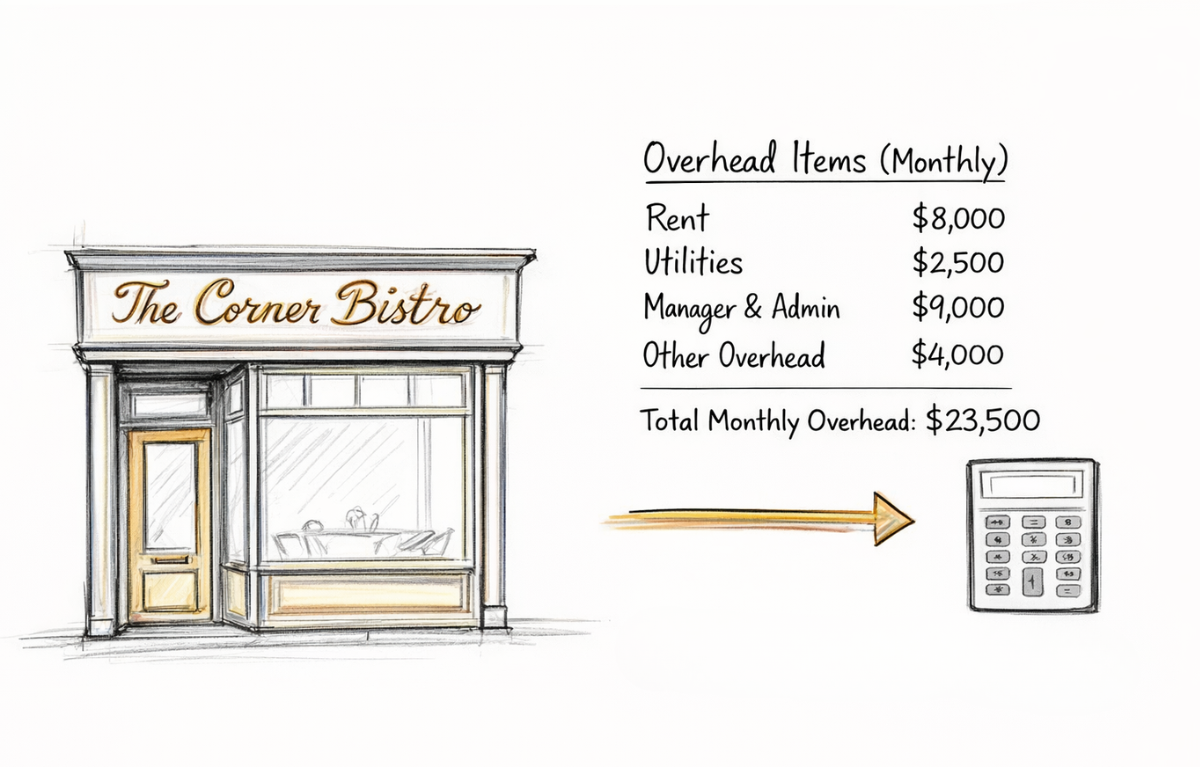

Theory is great, but seeing the numbers in action is where it really clicks. Let’s walk through a detailed, real-world scenario with a fictional restaurant, “The Corner Bistro.” This story gives you a clear blueprint to follow for your own books.

The Corner Bistro is a cozy, full-service spot focused on dinner service. The owner, Samantha Green, wants to get a handle on her overhead so she can accurately price a new seasonal menu item. Green decides the best way to do this is to calculate her overhead rate for the previous month based on direct labor hours, since her team’s service is so central to the guest experience.

Finding the Total Overhead

First things first, Samantha needs to round up all her indirect expenses for the month. These are all the costs that are not directly tied to making a specific dish. After digging through her accounting software and a stack of recent bills, she compiles the list.

Here’s what her monthly overhead looks like:

- Rent: $8,000

- Utilities (Gas, Electric, Water): $2,500

- Manager and Admin Salaries: $9,000

- Marketing and Advertising: $1,500

- Insurance: $800

- POS and Reservation Software: $400

- Repairs and Maintenance: $600

- Cleaning and Office Supplies: $700

When she adds it all up, Samantha’s total monthly overhead comes to $23,500. This is the nut she has to crack every month before even thinking about the direct costs of food and hourly labor.

Nailing Down the Allocation Base

Next up, she needs to figure out her total direct labor hours for that same month. This means all the hours worked by her cooks, servers, and bussers, everyone who has a direct hand in creating and serving the food.

She pulls the reports from her scheduling software and finds:

- Kitchen Staff Hours: 1,200 hours

- Front-of-House Staff Hours: 1,300 hours

Her total direct labor for the month is 2,500 hours. This number is her allocation base. It’s the metric she’ll use to spread her overhead costs evenly across her operations.

Putting the Formula to Work

Now Samantha has the two key pieces she needs. She grabs the formula for an overhead rate based on direct labor hours:

Overhead Rate = Total Overhead Costs / Total Direct Labor Hours

Plugging her numbers in is simple:

- $23,500 (Total Overhead) / 2,500 (Direct Labor Hours) = $9.40 per labor hour

This one number is a game-changer. It tells Samantha that for every single hour a direct employee is on the clock, The Corner Bistro is spending $9.40 on overhead. This is the hidden cost of doing business she has to build into her pricing strategy.

To make it even clearer, let’s lay it out in a table.

The Corner Bistro’s Monthly Overhead Calculation

| Expense Item | Monthly Cost | Calculation Step |

|---|---|---|

| Rent, Utilities, Admin Salaries, etc. | $23,500 | Step 1: Total All Indirect Costs |

| Kitchen and FOH Staff Hours | 2,500 hours | Step 2: Identify Allocation Base |

| Overhead Rate Calculation | $23,500 / 2,500 hours | Step 3: Apply the Formula |

| Final Overhead Rate | $9.40 per labor hour | The Result |

This table shows exactly how Green arrived at her hourly overhead rate, giving her a powerful tool for menu engineering and financial planning.

How to Use the Overhead Rate

So, what does Samantha actually do with this number? She uses it to accurately cost that new menu item: a braised short rib dish. She already knows the direct costs, the ingredients, and the specific labor needed to prep and plate it.

- Food Cost: The ingredients for one portion come out to $8.50. (If you want to get this number dialed in, you should learn all about mastering your food cost percentage.)

- Direct Labor: Her chef estimates it takes a line cook 30 minutes (0.5 hours) of active time to prepare and plate one dish.

- Overhead Application: Now, using her new rate, she can finally attach the right amount of overhead to the dish: 0.5 hours x $9.40/hour = $4.70.

By adding it all together, she sees the true, fully-loaded cost to produce one serving of the short rib is $17.20. That breaks down to $8.50 for food, plus an estimated direct labor cost, plus her newly calculated $4.70 in overhead.

With this number in hand, she can set a menu price that guarantees a healthy profit margin, moving way beyond simple guesswork.

Using Your Overhead Rate to Make Smarter Decisions

Calculating your overhead rate is only the starting point. Its real value comes from using it to make clearer, more confident business decisions across your operation.

With this number in hand, you can price menus, catering, and private events based on their true, fully loaded costs. Instead of guessing, you know whether a dish, event, or contract actually contributes to profitability once indirect expenses are accounted for. This turns pricing from a risk into a controlled decision.

Your overhead rate also helps you spot problems early. Comparing planned overhead to actual costs reveals where expenses are creeping up and where adjustments are needed. Unexpected spikes in utilities, maintenance, or admin costs become visible instead of quietly eroding margins.

At its best, the overhead rate is a decision-making filter. It helps you move from reacting to costs after the fact to proactively managing them before they impact profitability.

Common Overhead Calculation Mistakes to Avoid

Knowing the formula for your overhead rate is one thing. Sidestepping the common traps that skew your numbers is another game entirely. Even experienced operators can make small missteps that lead to bad data and even worse financial decisions.

Getting this right is not just about clean books; it’s about protecting your profitability. Learning from these frequent errors will save you a ton of time, money, and headaches down the road.

Misclassifying Your Costs

One of the most common mistakes is accidentally lumping a direct cost into your overhead pool. It sounds simple, but it happens all the time.

For instance, the wages for a line cook actively prepping and plating food are a direct labor cost, not overhead. Confusing the two inflates your overhead rate and gives you a completely warped view of what it actually costs to produce your menu items.

The only real fix here is discipline. Maintain a crystal-clear chart of accounts. Make it a regular habit to review your expenses and ensure every single dollar is categorized correctly, either as a direct cost tied to a sale or an indirect cost of keeping the lights on.

Using an Outdated Rate

Another classic pitfall is the “set it and forget it” approach. You run the numbers once at the beginning of the year and then use that same overhead rate for the next 12 months.

But your business is not static. Utility costs spike in the summer, produce prices change with the seasons, and your sales volumes can swing wildly from one quarter to the next.

An outdated rate leads you to systematically underprice or overprice everything from your daily menu to catering gigs, which directly hammers your profitability. The best practice is to review and recalculate your overhead rate at least quarterly. This cadence lets you adapt to what is actually happening in your business and ensures your financial decisions are based on current, relevant data.

Picking the Wrong Allocation Base

Finally, choosing an allocation base that does not accurately reflect how your business operates can throw everything off.

If you’re running a fine-dining restaurant where high-touch service is the name of the game, using machine hours as your base makes zero sense. On the other hand, a highly automated ghost kitchen would get misleading data by relying solely on direct labor hours.

The key is to pick the driver that has the strongest, most logical connection to your overhead costs. For most restaurants, direct labor hours or total direct costs are the safest and most accurate choices. Think about what truly drives your operation’s costs and align your allocation base accordingly. This is how you make sure you’re spreading your overhead in the most meaningful way possible.

Common Questions About Restaurant Overhead

Let’s clear up a few of the things operators ask most.

How often should I recalculate my restaurant’s overhead rate?

For most restaurants, recalculating your overhead rate quarterly is a solid best practice. This rhythm is frequent enough to catch seasonal swings in costs like utilities or marketing and lets you adjust for big changes in sales volume. It keeps your numbers relevant and your pricing sharp.

That said, if a major event happens, a new lease, a big salary bump for your managers, or a hefty equipment purchase, do not wait. Recalculate immediately. Making decisions on last quarter’s numbers after a huge change is like driving with an old map.

What is a good overhead rate for a restaurant?

Honestly, there is no magic number. A “good” rate is completely dependent on your concept, location, and business model. A fine-dining spot in downtown Manhattan will have a wildly different overhead structure than a quick-service taco stand in the suburbs.

Instead of chasing a universal benchmark, focus on tracking your own rate over time. Your goal is to spot your own trends and make sure your total prime costs (cost of goods sold + total labor) stay in a healthy zone, which for many is 60% of revenue or less.

Can my POS or accounting software help calculate this?

Yes, absolutely. In fact, the tech you already use is the key to making this process way less painful.

Your accounting software, whether it’s QuickBooks or Xero, is already set up to categorize and add up all your indirect costs. At the same time, your POS system holds all the data for your allocation base, like total sales or the direct labor hours your team worked.

By simply exporting reports from these two systems, you can pull together the numbers you need in a fraction of the time. It makes calculating your overhead rate something you can actually do on a regular, consistent basis without losing a Saturday.

Running a restaurant is tough, but you do not have to do it alone. MAJC✨ is a community-driven platform built by operators, for operators, to help you hire better, retain longer, and run smarter. Access the tools, training, and expert network you need to build a more profitable and sustainable business. Join the community and get the support you deserve.